VA Loan Hack with Seller Credits

VA Loans w/ 500 Credit Score

No VA Loan Limit

What is the VA funding fee?

VA loans offer competitive interest rates and more relaxed credit standards compared to conventional mortgage loans, and they do not require mortgage insurance. Instead, these loans include a VA funding fee, a one-time charge that borrowers can pay upfront or incorporate into their mortgage. This fee ranges from 1.25% to 3.3% of the total loan amount, depending on the borrower's down payment size and whether it is their first time using a VA loan.

These loans are supported by the Department of Veterans Affairs, which offers a guarantee to repay a portion of the loan should the borrower default. The funding fee serves to cover the expenses associated with this guarantee, ensuring the sustainability of the VA loan program.

How much is the VA funding fee?

The VA funding fee varies based on the down payment amount and whether the borrower has previously used a VA-backed loan. For those who have used a VA loan before, any new loan is referred to as a "subsequent use."

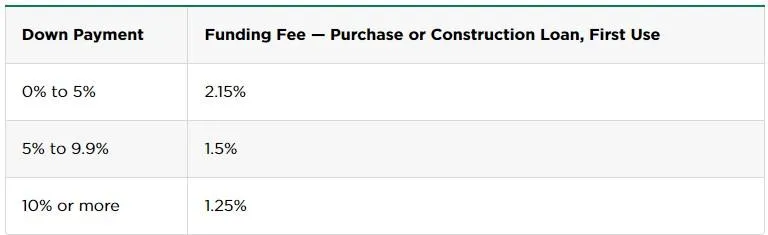

For purchase loans or construction loans, the funding fee structure is as follows:

For purchase loans or construction loans, the funding fees are:

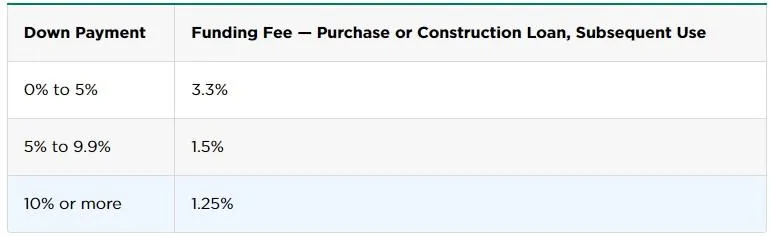

Funding fees for a subsequent VA loan are:

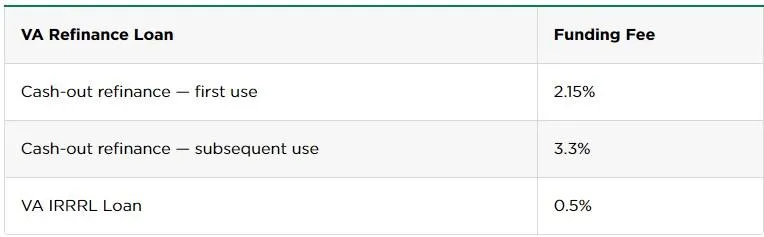

Funding fee for Interest Rate Reduction Refinance Loans:

Paying the VA funding fee:

There are two ways to pay the VA funding fee: either in full at closing or by incorporating it into your total loan amount, allowing you to pay it over time.

Paying the fee upfront at closing avoids adding to your loan balance, but it requires a significant one-time payment. On the other hand, rolling the fee into your loan spreads the cost over the life of the mortgage, increasing your monthly payments and the overall cost of the loan due to interest accrual.

Another option is to negotiate with the seller to cover the funding fee, though this may not always be successful, particularly in a seller's market.

Additionally, the VA funding fee may be tax deductible. If you pay it all at once, you can deduct the full amount in that tax year. If you roll it into your loan, you can deduct the portion of your monthly payments that applies to the fee each year.

Getting a refund for your funding fee

If you secure a VA loan and are later granted retroactive disability compensation, you may be eligible for a refund of the VA funding fee payments you've made. This refund applies whether you paid the fee upfront at closing or rolled it into your loan amount.

The Department of Veterans Affairs will typically issue the refund based on the effective date of your disability compensation, adjusting for any payments made prior to your disability determination. If the fee was financed into your loan, the refunded amount will be applied directly to your mortgage principal, potentially reducing your remaining balance and the interest you pay over time.

This is not a commitment to lend. All loans are subject to credit approval. This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. Other limitations may apply. No Tax Return loans products require other forms of income documentation and asset verification in lieu of tax returns. Not all applicants will qualify. Some products we offer may have a higher interest rate, more points or more fees than other products requiring more extensive or different documentation. Minimum FICO, reserve, and other requirements apply.

Kurt Raymond Kessler NMLS #365130 | Barrett Financial Group, L.L.C. NMLS #181106 | 2701 East Insight Way, Suite 150, Chandler, AZ 85286 | CA 60DBO-46052 & 41DBO-148702

Licensed by Dept. of Financial Protection & Innovation under the California Residential Mortgage Lending Act. Loans made or arranged pursuant to a California Financing Law License

Licensing | Legal | Privacy-Policy/Terms & Conditions | Accessibility Statement | NMLS Consumer Access | www.barrettfinancial.com

All Rights Reserved | Copyright © 2025