What is DTI - Debt-to-Income Ratio

The Debt-to-Income (DTI) ratio is a financial metric that lenders often use to assess a borrower's ability to manage monthly payments and repay debts. It is expressed as a percentage and represents the relationship between a person's monthly debt payments and their gross monthly income.

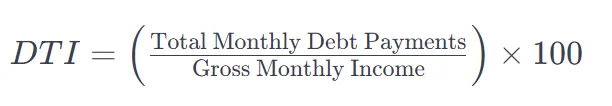

The formula for calculating the DTI ratio is:

To calculate your DTI, you would typically add up all your monthly debt payments, including mortgage or rent, car loans, credit card payments, student loans, and other monthly debts. Then, divide that total by your gross monthly income (your income before taxes and other deductions) and multiply the result by 100 to get the percentage.

Lenders use DTI as a key factor in assessing a borrower's creditworthiness. A lower DTI ratio is generally considered favorable, indicating that a person has more income available to cover their debt obligations. Different lenders may have varying DTI ratio requirements, but a common guideline is that a DTI ratio of 43% or lower is often considered acceptable for most types of loans.

It's important to note that the acceptable DTI ratio can vary based on the type of loan and the lender's specific criteria. Different loans (such as mortgages, auto loans, or personal loans) may have different acceptable DTI thresholds. Additionally, individual financial situations and credit histories are considered when evaluating loan applications.

Kurt Kessler

NMLS# 365130

(925) 400-3850 | [email protected] KurtKessler.com | BuildwithKurt.com

This is not intended to establish standards or requirements, Agents are advised to seek confirmation and legal guidance that reflects their specific state's regulations and Laws.

This is not a commitment to lend. All loans are subject to credit approval. This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. Other limitations may apply. No Tax Return loans products require other forms of income documentation and asset verification in lieu of tax returns. Not all applicants will qualify. Some products we offer may have a higher interest rate, more points or more fees than other products requiring more extensive or different documentation. Minimum FICO, reserve, and other requirements apply.

Kurt Raymond Kessler NMLS #365130 | Barrett Financial Group, L.L.C. NMLS #181106 | 2701 East Insight Way, Suite 150, Chandler, AZ 85286 | CA 60DBO-46052 & 41DBO-148702

Licensed by Dept. of Financial Protection & Innovation under the California Residential Mortgage Lending Act. Loans made or arranged pursuant to a California Financing Law License

Licensing | Legal | Privacy-Policy/Terms & Conditions | Accessibility Statement | NMLS Consumer Access | www.barrettfinancial.com

All Rights Reserved | Copyright © 2025