FHA Mortgage Insurance Premiums

All FHA loans come with a requirement for mortgage insurance, which serves to protect lenders in case of borrower default. When you purchase a home with an FHA loan, you'll encounter two types of mortgage insurance:

Upfront Mortgage Insurance Premium (UFMIP): This is a one-time fee that you pay at closing. It's calculated as a percentage of your total loan amount.

Monthly Mortgage Insurance Premium (MIP): This is a recurring charge that you'll pay along with your monthly loan payment. The amount depends on several factors including your loan amount, loan-to-value ratio, and the length of your mortgage.

The cost of FHA mortgage insurance varies based on the amount you borrow, your down payment, and the term of your loan. Understanding these costs is crucial as they affect your monthly payments and the overall cost of your loan.

How much is the FHA Upfront Mortgage Insurance Premium (UFMIP)?

When obtaining an FHA loan, one of the required costs is the Upfront Mortgage Insurance Premium (UFMIP). This premium is charged at a rate of 1.75% of your total loan amount.

Here’s how it works:

Calculation and Collection: At closing, your lender will calculate the UFMIP based on your loan amount. For instance, if your loan amount is $100,000, the UFMIP would be $1,750.

Payment: Although this fee is collected at closing, most homebuyers choose to finance the UFMIP by adding it to their total loan amount. Using the previous example, financing the UFMIP would increase your total loan amount from $100,000 to $101,750.

Loan Estimate: Your lender will provide a Loan Estimate that details the amount of the UFMIP and other closing costs associated with your loan.

Closing Cost Calculator: To get a clearer picture of your total closing costs, including the UFMIP, you can use a closing cost calculator. This tool helps you estimate all expenses due at closing, allowing you to plan your finances accordingly.

Financing the UFMIP is a common practice as it helps reduce the amount of cash you need to bring to closing, but it slightly increases the overall loan amount and, consequently, your monthly mortgage payments.

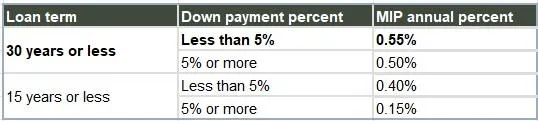

FHA MIP for loans of $766,550 and less

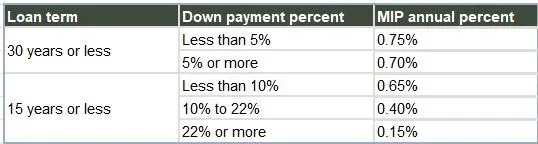

FHA MIP for loans greater than $766,550

This is not a commitment to lend. All loans are subject to credit approval. This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. Other limitations may apply. No Tax Return loans products require other forms of income documentation and asset verification in lieu of tax returns. Not all applicants will qualify. Some products we offer may have a higher interest rate, more points or more fees than other products requiring more extensive or different documentation. Minimum FICO, reserve, and other requirements apply.

Kurt Raymond Kessler NMLS #365130 | Barrett Financial Group, L.L.C. NMLS #181106 | 2701 East Insight Way, Suite 150, Chandler, AZ 85286 | CA 60DBO-46052 & 41DBO-148702

Licensed by Dept. of Financial Protection & Innovation under the California Residential Mortgage Lending Act. Loans made or arranged pursuant to a California Financing Law License

Licensing | Legal | Privacy-Policy/Terms & Conditions | Accessibility Statement | NMLS Consumer Access | www.barrettfinancial.com

All Rights Reserved | Copyright © 2025