Debt Service Coverage Ratio (DSCR)Loans

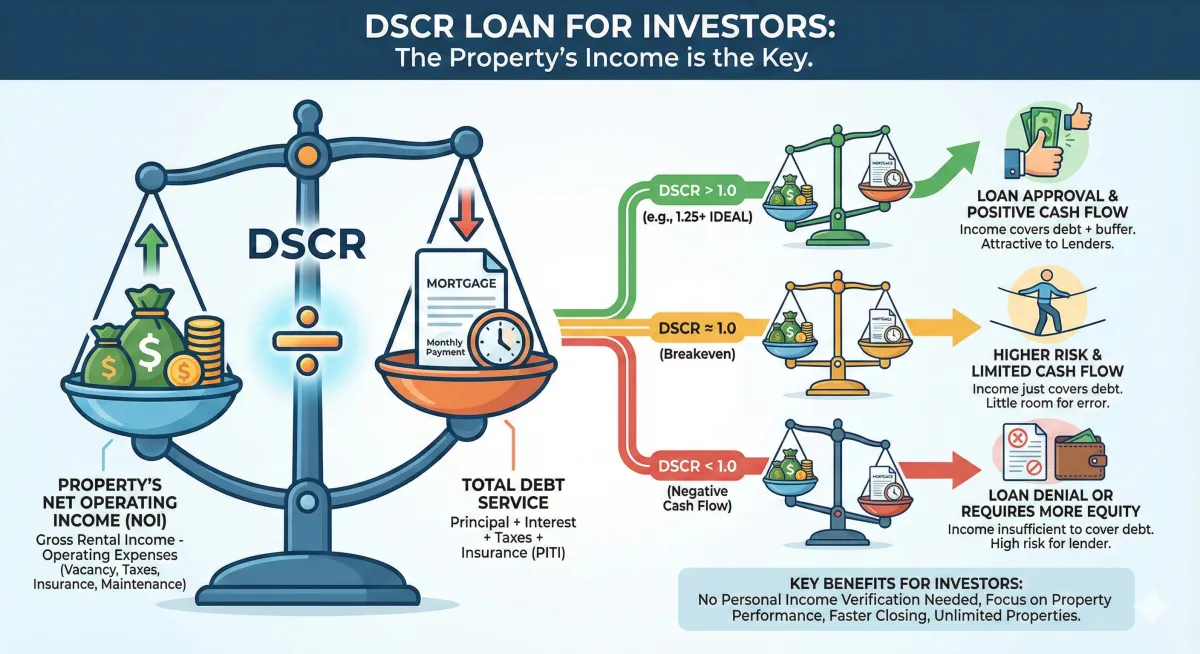

A DSCR loan refers to a Debt Service Coverage Ratio loan, where DSCR is an acronym for Debt Service Coverage Ratio. This type of loan is often associated with commercial real estate financing. The Debt Service Coverage Ratio is a financial metric that assesses a borrower's ability to cover their debt obligations, particularly in the context of income-generating properties.

Here's how DSCR loans typically work:

Debt Service Coverage Ratio (DSCR): DSCR is calculated by dividing a property's net operating income (NOI) by its debt service (loan payments). The formula is:

Net Operating Income (NOI):

This is the income generated by a property after deducting operating expenses, but before accounting for debt service.

Debt Service:

This represents the total debt payments, typically including both principal and interest, on the property.

DSCR Loan: A DSCR loan is structured with a focus on the Debt Service Coverage Ratio. Lenders use the DSCR to evaluate the risk associated with the loan and to ensure that the property generates sufficient income to cover its debt obligations.

Acceptable DSCR:

Lenders often have minimum DSCR requirements for approving loans. A DSCR below 1 indicates that the property's income is insufficient to cover its debt obligations, which is considered risky. Lenders typically prefer a DSCR above 1 to ensure a margin of

safety.

Loan Amount:

The loan amount in a DSCR loan is often determined based on the property's ability to generate income and maintain an acceptable DSCR. Lenders may limit the loan amount to ensure that the property's income is adequate to cover debt payments.

Interest Rates:

The interest rates for DSCR loans may depend on the perceived risk associated with the property and the borrower. A higher DSCR may result in more favorable loan terms.

Commercial Real Estate: DSCR loans are commonly used in commercial real estate financing, where properties generate rental income. This includes various types of commercial properties such as office buildings, retail spaces, and multifamily residential buildings.

DSCR loans are particularly important in commercial real estate financing because they provide a measure of the property's cash flow and its ability to meet debt obligations. Investors and lenders use DSCR as a key metric to assess the financial health and risk of a commercial property.

It's important to note that DSCR loans are primarily associated with commercial real estate, and the application of DSCR in residential mortgages is less common. Additionally, the specific terms and criteria for DSCR loans can vary among lenders.

This is not a commitment to lend. All loans are subject to credit approval. This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. Other limitations may apply. No Tax Return loans products require other forms of income documentation and asset verification in lieu of tax returns. Not all applicants will qualify. Some products we offer may have a higher interest rate, more points or more fees than other products requiring more extensive or different documentation. Minimum FICO, reserve, and other requirements apply.

Kurt Raymond Kessler NMLS #365130 | Barrett Financial Group, L.L.C. NMLS #181106 | 2701 East Insight Way, Suite 150, Chandler, AZ 85286 | CA 60DBO-46052 & 41DBO-148702

Licensed by Dept. of Financial Protection & Innovation under the California Residential Mortgage Lending Act. Loans made or arranged pursuant to a California Financing Law License

Licensing | Legal | Privacy-Policy/Terms & Conditions | Accessibility Statement | NMLS Consumer Access | www.barrettfinancial.com

All Rights Reserved | Copyright © 2025