FHA Appraisals 5 Pain Points

FHA allows ADU Income!

FHA Income Hack

How An FHA MIP Refund Works

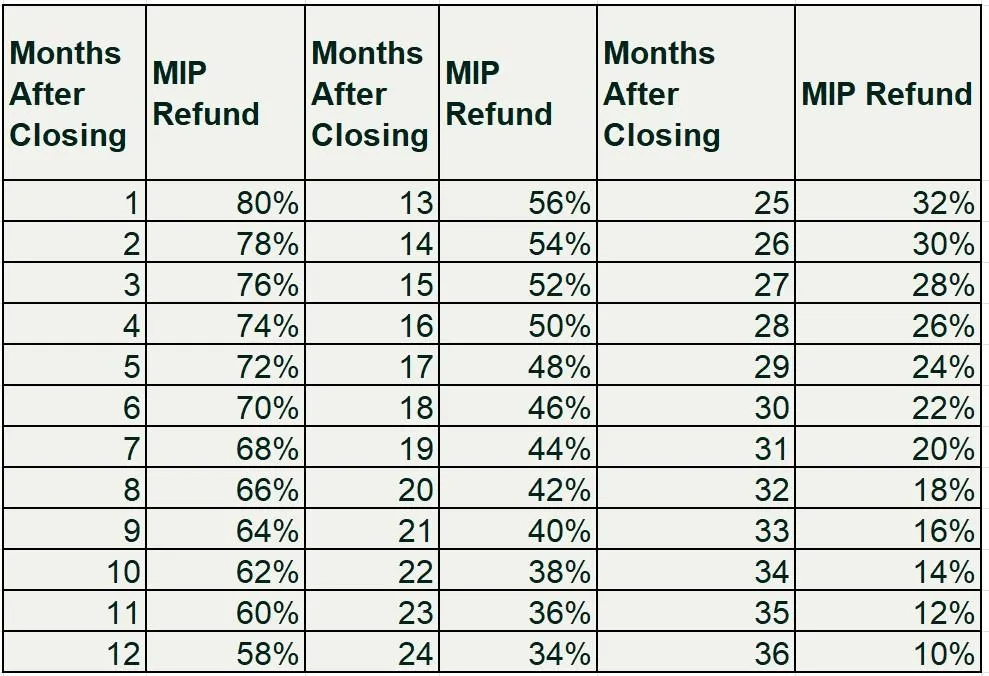

When you refinance your FHA loan to another loan insured by the Federal Housing Administration, the amount of your FHA Mortgage Insurance Premium (MIP) refund largely depends on the timing of your refinance.

Here’s how it works:

If you refinance within the first 12 months, you can receive a refund of 58% of your initial upfront MIP payment.

If you refinance after three years, the refund drops to just 10% of your upfront payment.

It's important to note that this refund is not issued as cash. Instead, it is applied directly to the upfront MIP required for your new FHA loan. This effectively reduces the amount you need to pay for the upfront MIP on the new loan. The FHA policy strictly prohibits disbursing MIP refunds as cash to borrowers.

The percentage of your refund decreases the longer you wait to refinance. While the prospect of a refund might seem appealing, it’s crucial to consider whether refinancing truly benefits you financially. If your current loan has a favorable interest rate, and you're satisfied with the terms and monthly payments, it may not be advantageous to refinance just to obtain a refund. Always weigh the overall financial impact and your personal circumstances before deciding to refinance.

FHA MIP Refund Chart

Eligibility Requirements For FHA MIP Refunds

To be eligible for an FHA Mortgage Insurance Premium (MIP) refund when refinancing, you must meet specific criteria:

1) Timing of Original Loan: Your original FHA loan must have been closed less than three years ago. Refinancing after this period means you won't qualify for the MIP refund.

2) Payment History: You must be current on your mortgage payments. This means no late payments at the time you apply for the refinance.

3) Credit Report Requirements: Your credit report must not show any foreclosures. A foreclosure would disqualify you from receiving an MIP refund.

4) Type of Refinance: The refinance must be into another FHA loan. Refinancing your existing FHA loan into a non-FHA loan type disqualifies you from receiving an MIP refund.

Meeting these conditions is essential to take advantage of the MIP refund, which can significantly reduce the upfront cost of your new FHA loan by applying the refund amount to the new loan's upfront MIP payment. Always verify your eligibility and calculate the potential benefits before proceeding with a refinance.

How To Request An FHA MIP Refund

When you refinance your FHA loan, the process for obtaining a refund of your upfront Mortgage Insurance Premium (MIP) is handled automatically by your lender. You do not need to request the refund yourself.

Here’s what happens:

Your lender will determine your eligibility for an MIP refund based on the criteria such as the timing of your original loan closure, your payment history, and the type of loan you're refinancing into.

If you are eligible, the refund amount will automatically be applied to the upfront MIP payment required for your new FHA loan.

This arrangement simplifies the process for you, as the lender manages all the details, ensuring the refund reduces the upfront cost of refinancing. Always ensure that your lender is aware of your previous FHA loan details to facilitate the refund process seamlessly.

This is not a commitment to lend. All loans are subject to credit approval. This information is not intended to be an indication of loan qualification, loan approval or commitment to lend. Other limitations may apply. No Tax Return loans products require other forms of income documentation and asset verification in lieu of tax returns. Not all applicants will qualify. Some products we offer may have a higher interest rate, more points or more fees than other products requiring more extensive or different documentation. Minimum FICO, reserve, and other requirements apply.

Kurt Raymond Kessler NMLS #365130 | Barrett Financial Group, L.L.C. NMLS #181106 | 2701 East Insight Way, Suite 150, Chandler, AZ 85286 | CA 60DBO-46052 & 41DBO-148702

Licensed by Dept. of Financial Protection & Innovation under the California Residential Mortgage Lending Act. Loans made or arranged pursuant to a California Financing Law License

Licensing | Legal | Privacy-Policy/Terms & Conditions | Accessibility Statement | NMLS Consumer Access | www.barrettfinancial.com

All Rights Reserved | Copyright © 2025